Setting up the QuickBooks Online integration

NAVIGATION Left navigation menu > Apps ![]() > QuickBooks Online

> QuickBooks Online

This integration allows you to sync your Kaseya Quote Manager organizations, sales, and purchases to QuickBooks Online. Learn about QuickBooks Online.

Syncing to and from QuickBooks Online requires approximately 10 minutes.

This article outlines the process to integrate QuickBooks Online with Kaseya Quote Manager.

In your Kaseya Quote Manager Admin Center, complete the following steps to connect the QuickBooks Online app:

- From the left navigation menu, click Apps

.

. - Click the QuickBooks Online tile.

- Click Install app.

- Once the installation is finished, click Connect to QuickBooks.

- Enter your QuickBooks Online login credentials and click Sign In.

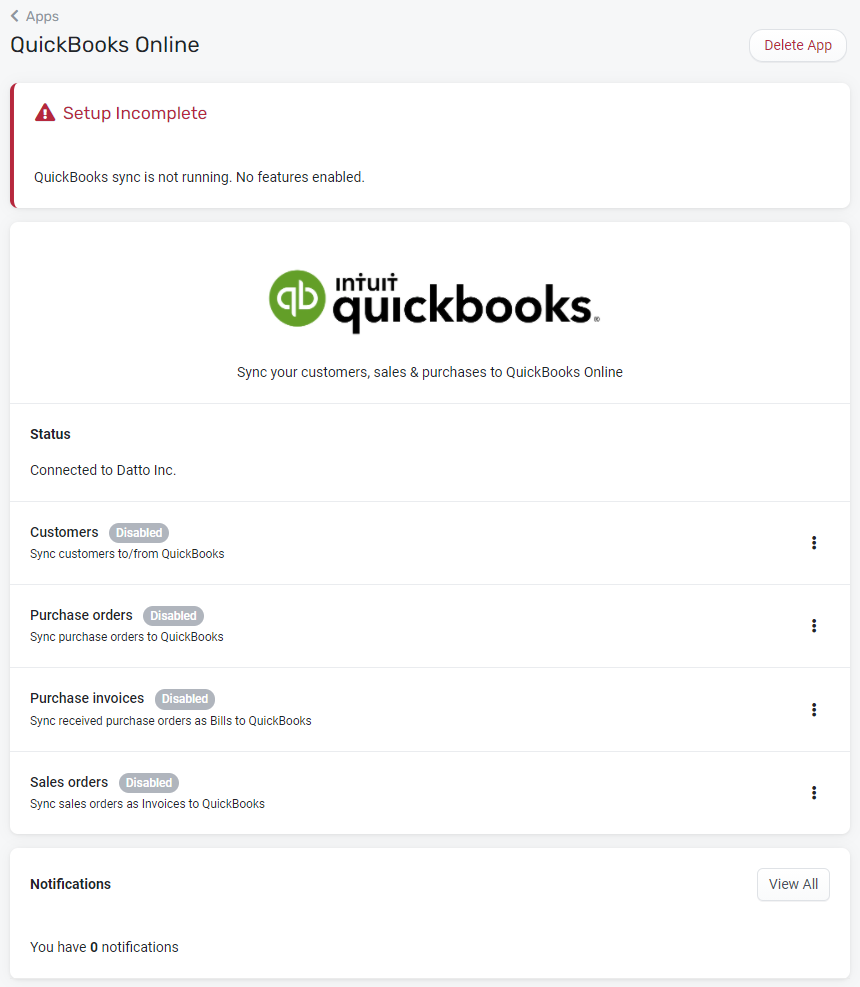

- The sync configuration page will open in Kaseya Quote Manager, showing the status as Connected.

After you have connected Kaseya Quote Manager to QuickBooks Online, the syncing of specific items is still disabled.

Workflow

Run Kaseya Quote Manager with QuickBooks Online in a standalone configuration or along with your PSA system.

Your chosen workflow will determine whether:

- sales are processed as sales orders or as tax invoices.

- organization sales orders sync to QuickBooks Online via your PSA system or directly to QuickBooks from Kaseya Quote Manager.

- supplier purchase orders sync to QuickBooks Online via your PSA system or directly to QuickBooks from Kaseya Quote Manager.

Refer to Processing for detailed workflow explanations. You may change your configuration at any time.

Setting up QuickBooks Online sync options

The following items can be synced with QuickBooks Online:

NOTE Organization sync is only required if you choose to sync sales orders.

Set up the organizations sync as follows:

- Click the Organizations section.

- Turn on the toggle to Sync organizations to/from QuickBooks.

- Click Save.

Set up the purchase orders sync as follows:

- Click the Purchase orders section.

- Turn on the toggle to Sync purchase orders to QuickBooks.

- Select the calendar date from which you'd like to sync information.

United States organizations

The integration only allows for AST (Automated Sales Tax) to be synced and then calculated by QuickBooks Online, which requires an exemption certificate for a vendor. If the vendor does not have an exemption certificate, do not map them.

Australia and New Zealand organizations

Depending on your internal QuickBooks Online setup, select at least one GST (Goods and Services Tax) account for purchases and at least one for sales.

Creditors are the purchase order bills that will be synced to QuickBooks Online.

QuickBooks Online provides the option to map to Accounts Payable (A/P).

Map your physical products, non-physical products, and services from Kaseya Quote Manager to their corresponding items in QuickBooks Online.

NOTE The integration does not support syncing to inventory items.

Map delivery, delivery surcharge, and general surcharges (for example: credit card surcharges) to their relevant account. These are items in QuickBooks Online in the case of shipping surcharges or payment surcharges. Hence, they should be service items.

Map your Kaseya Quote Manager suppliers to those configured in QuickBooks Online.

Set up the purchase invoices sync as follows:

- Click the Purchase invoices section.

- Turn on the toggle to Sync received purchase orders to QuickBooks Bills.

- Select the calendar date from which you'd like to sync information.

The QuickBooks Online sync will inform you of any items that were not resolved in the previous stage.

Set up the sales orders sync as follows:

- Click the Sales orders section.

- Turn on the toggle to Sync sales orders to QuickBooks.

- Select the calendar date from which you'd like to sync information.

- Create your document prefix in QuickBooks Online. You may opt for sequential numbering for QuickBooks Online invoices. To do so, turn on the toggle for Use QuickBooks generated invoice numbers.

- Select where you would like your organizations/organization purchase orders to display in QuickBooks Online.

NOTE By default, this is set as the memo section.

United States organizations

The integration only allows for AST (Automated Sales Tax) to be synced and then calculated by QuickBooks Online, which requires an exemption certificate for a vendor. If the vendor does not have an exemption certificate, do not map them.

Australia and New Zealand organizations

Depending on your internal QuickBooks Online setup, select at least one GST (Goods and Services Tax) account for purchases and at least one for sales.

Discounts relate to activity such as coupon usage. Select the applicable discount account to map to.

Map your physical products, non-physical products, and services from Kaseya Quote Manager to their corresponding items in QuickBooks Online.

NOTE The integration does not support syncing to inventory items.

Map delivery, delivery surcharge, and general surcharges (for example: credit card surcharges) to their relevant account. These are items in QuickBooks Online in the case of shipping surcharges or payment surcharges. Hence, they should be service items.

Syncing Stripe data to QuickBooks Online

QuickBooks Online offers a tool to automate the transfer of Stripe sales activity into QuickBooks. Learn more. Benefits of this automated bookkeeping feature include the following:

- Saves time and increases accuracy by replacing manual data entry.

- Complete visibility of reports aids in financial decision-making.

- Direct access to a team with expertise in both Stripe and QuickBooks.